Here's a short preview of my latest book, Author Bookkeeping Made Easy. You can grab a copy on Kindle by visiting this link. (After you've had a chance to read it, please stop back to Amazon and leave an honest review. It will help me with my writing, and it will help other readers decide whether it can help them with their author bookkeeping needs.)

Why you need to read this book

Authors work with words. Accountants work with numbers. So what does bookkeeping have to do with writing, you may ask?

Good question.

The answer could mean thousands of extra dollars in your back pocket.

Too many authors get so excited about the money rolling in they never bother to add it all up to see if they’re making a profit. Not until it’s too late, anyway.

To run a successful writing business, you need to make a profit. The more profit you make, the healthier your business is. Unfortunately, too many authors never stop to look at the big picture. They assume that because the money keeps flowing in, they must be making a profit.

I felt the same way the first year my books were on Kindle. I earned nearly ten thousand dollars in royalties that year, and I naturally assumed I was making money. Every time I turned around, there was another deposit in my bank account. I had to be making money. The thing was when I totaled it all up at the end of the year I really only made a couple thousand bucks.

How could that be?

Simple answer: I spent more money than the royalties I received. The long answer was I kept spending money I should have socked away. I bought a new laptop, another iPhone, a Kindle, and don’t forget Fiverr. I commissioned 179 Fiverr’s over the course of one year – covers, infographics, videos, you name it.

Smart author’s tie their spending to their cash flow. If they project $10,000 in royalties, they determine they can spend a certain amount for research and goodies. If they project $25,000 in royalties, they allow themselves to spend a few bucks more tracking down that last scrap of necessary research, designing one more alternate cover, or acquiring the latest greatest electronic gadget.

Of course, research expenses, covers, and computer equipment are only a few of the ingredients involved in planning cash flow. Authors need to look at all of their expenses when they make cash flow projections.

A simple author’s budget would likely have many of the expenses listed below:

1) Research expenses

2) Books

3) Travel

4) Review copies

5) Art work (for covers, promotions, flyers, etc.)

6) Gas and mileage for your car

7) Advertisements to promote your books

8) Google AdWords / Facebook Ads

9) Equipment (computers, printers, etc.)

While not an all-inclusive list, this will give you an idea of the expenses you need to track. You also need to track your sources of income.

These are some of the income sources you’re likely to encounter:

1) Kindle royalties

2) Create Space royalties

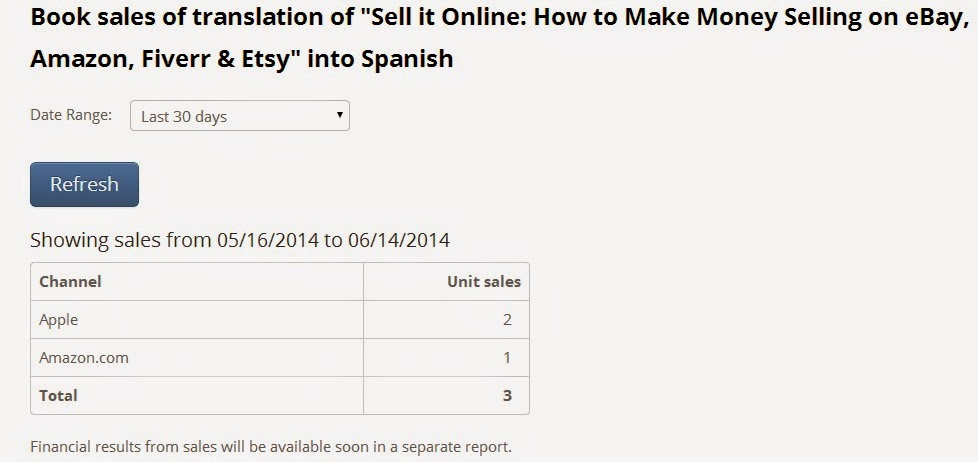

3) Smashwords royalties

4) Barnes & Noble royalties

5) Google Play & Google Books royalties

What this book is going to do is help you take a better look at your income and expenses.

We’re going to examine several different methods of tracking your expenses. GoDaddy Bookkeeping (formerly known as Outlook) is an easy to use program that makes it more convenient for authors to record their earnings and expenses. Some authors prefer simpler methods, such as using an Excel spreadsheet or a paper journal.

Accounting solutions such as GoDaddy Bookkeeping can make things easier by automatically importing transaction information from your checking accounts and credit card accounts. It gives you the ability to set up separate income and expense accounts that make the program more flexible.

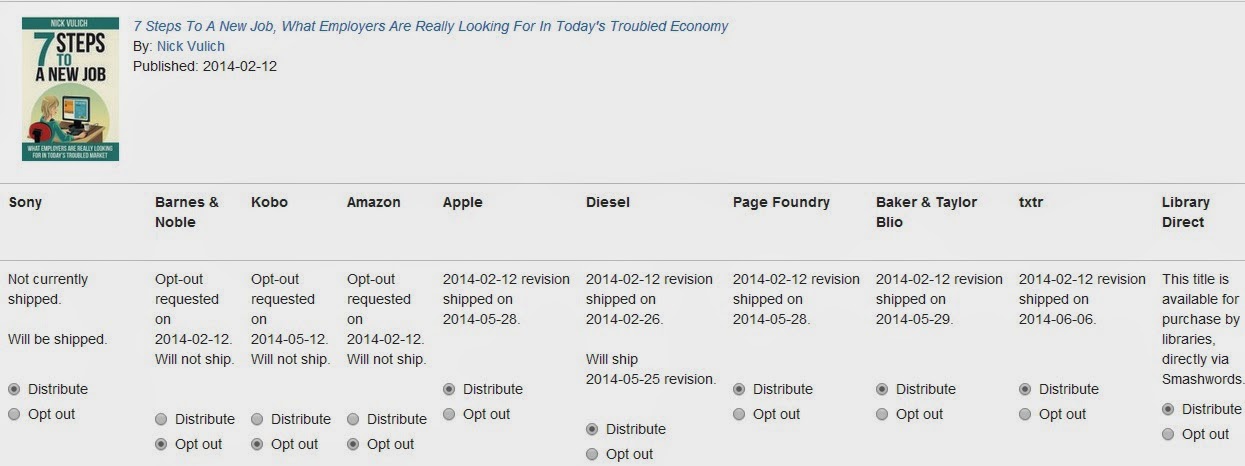

In my case, I set up separate income accounts for my Create Space, Smashwords, Barnes & Noble & ACX royalty payments so I could track that data alongside my Kindle royalties. I will go into more detail on this later and show you how to do it.

Before I go any further let me tell you a little more about me, so you can understand why I’m the right guy to help you with your author accounting needs.

Why Listen to Me?

Hey there, Nick Vulich here.

Although I’m relatively unknown in the publishing world, it’s not for lack of trying. I’ve published more than thirty books over the last several years. Most of them are available as paperbacks, eBooks, and most recently as audio books.

What that means is I’ve been there, and done that. I know what it’s like to go to work every day, come home, spend time with the family, spend half the night working on your new book, and get up early the next morning to drag your ass through it all over again.

One thing you’ll discover is I’m not shy about telling you what I think.

I’ve run an online business selling on eBay and Amazon for the past fifteen years. Much of what I cover in this book is adapted from what I learned in those businesses. If I tell you about a tax deduction, tax credit, or computer program that can help you along the way, it’s because I use those programs and I know they work.

If I’ve just heard about something, but have never tried it, I’ll tell you that up front.

Let’s get started

Getting Started

What’s that you say? You don’t know the difference between a debit and a credit. Balancing your checkbook is a weeklong task. So how are you ever going to figure out business accounting, let alone get the right info together for Uncle Sam?

Don’t sweat it.

Modern accounting programs have simplified everything, so you don’t need to know the difference between a debit and a credit.

If you can punch your sales and expenses into the right category, these programs will work their magic and show you the final results – whether you made a profit or a loss.

Get Organized

The first thing you’re going to need is a system to organize and store your receipts and records. Some authors use a file cabinet. Some use expandable file folders. I like to use loose-leaf binders. I normally select a five-inch binder, monthly divider inserts, and storage pocket inserts.

Storing everything this way keeps all of my business records readily accessible, and the binder fits neatly on my bookshelf. I can store fifteen years of business records side-by-side in a relatively small space.

Save Your Receipts

Get used to it now. You need to save all of your receipts.

When you buy something online, print out the invoice, punch it with a three hole punch and store it in your three-ring binder under the month of purchase.

Save all of your mortgage or rent receipts, utility bills, phone bills, cable bills, sewer bills, etc. Store them in a zipper pouch in your binder. You’re going to need them to file for the home office deduction. It’s going to save you thousands of dollars on your taxes every year.

If you purchase supplies at Walmart, Staples, Office Depot, etc. save your receipts in a No. 10 envelope. Label the envelopes by month and store them in a zipper pouch in your binder.

Start Writing Down Your Mileage

Go to Walmart, Target, or your office supply superstore and buy a mileage log. They cost about three bucks and can save you close to a thousand dollars over the course of the year.

Starting today – You need to write down the beginning mileage on your vehicle. Every time you get in the car to run to the post office, check out a new fact, or anything related to your writing business – write it down.

You need to record your beginning and ending mileage. Jot down a quick note about where you went, or why you went there. It doesn’t have to be a novel or anything fancy. Post Office, bank, library – just something to leave a trail of how it was business related.

Save all of your auto-related receipts as well. The government lets you deduct your actual travel related expenses, or the mileage deduction (56¢ this year), whichever is greater. To ensure the largest deduction, you need to save your car payment stubs, insurance payment records, gas receipts, repair bills, oil change receipts, anything related to your car. Grab another No. 10 envelope for each month, and label it auto expenses.